Discovery-Driven Checkpoints for Growth Success

Aug 22, 2023Growth programs need a different plan for progress than the operating business needs

Executives without experience in bringing new ventures to life — whether as entrepreneurs, business leaders, those with transformation responsibilities or other change agents — often think that planning a new venture is like planning for an existing business. It isn’t. It really isn’t, as I’ve written about for many years.

One of the main differences is that new ventures are best planned to take advantage of option value. You do this by working through a series of checkpoints, so that as you meet each checkpoint, your knowledge increases and your confidence that investment is merited can increase. The watchword is to plan to the next checkpoint with great determination, then stop, look at what you’re learned, and plan to the subsequent checkpoint. It sounds simple, and it is, but it can feel terribly unfamiliar to those who are new to the whole high-uncertainty, venturing world. In this article, I’ll lay out 20 checkpoints that most new ventures will go through, though not necessarily all, and not necessarily in this sequence. I’ve therefore not numbered them.

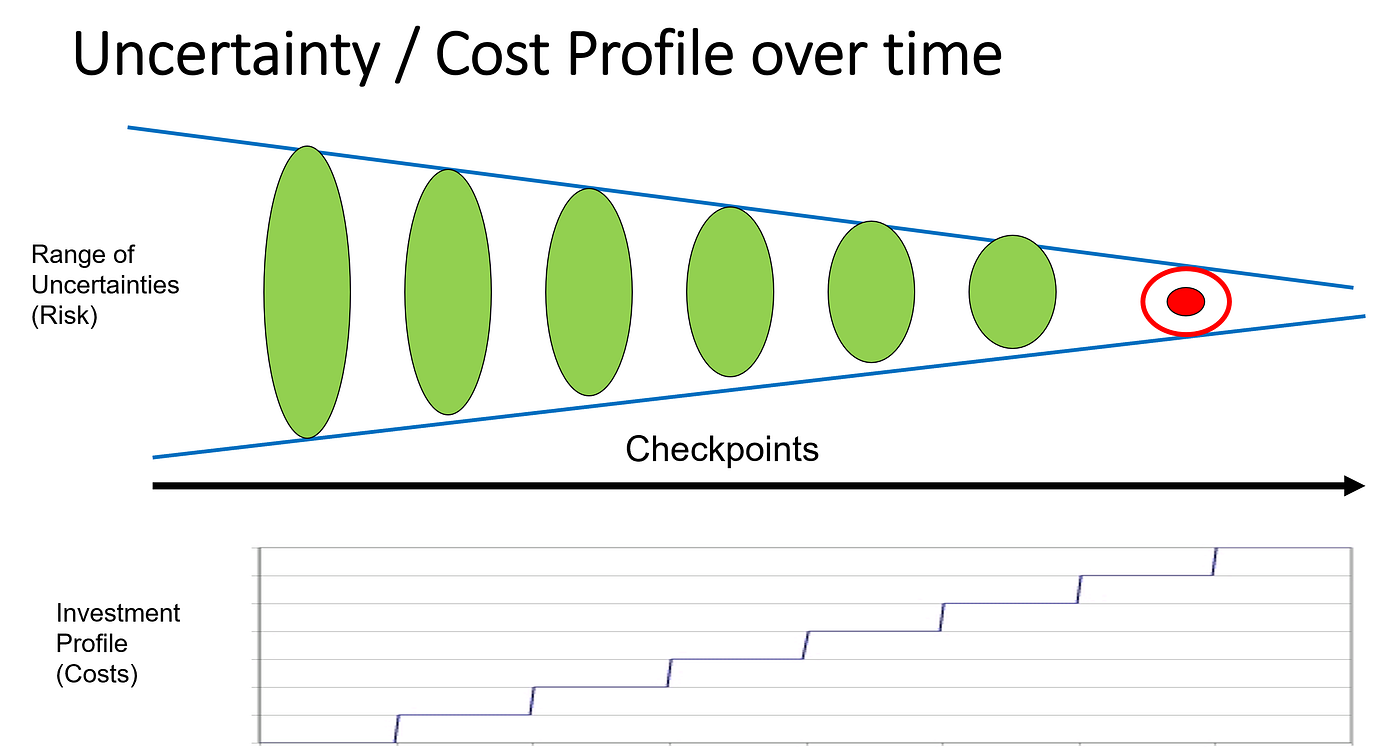

As the picture below shows, the goal is to balance your investment in a new area against how much learning you have done, represented by the range of possible answers you have discovered. As you gain in knowledge, your range narrows and you can invest with greater confidence.

Initial Customer Interviews

At this checkpoint, what you are trying to ascertain is what the customers’ key “jobs to be done” are and whether some solution that you might have is potentially going to meet that need. I turn to the brilliant work of Alberto Savoia on this — the key idea is not to build something and hope someone will buy it. Instead, find out what someone will buy, and build that!

The goal at this checkpoint is to come up with a “job to be done” that isn’t getting done or is getting done badly. You want to get clarity on a need, problem, issue that customers might pay to resolve. This article by veteran entrepreneur Steve Blank updates conventional customer discovery processes for doing the same thing in an era of COVID-19.

Competitor Assessment

Here, what you are looking to figure out are four categories of competition. The first, and least obvious to many entrepreneurs is the decision on the part of the customer to do nothing at all. Non-consumption is a powerful form of competition, so how are you going to prompt action?

The next category are obvious — players who provide the same solution you do, perhaps in a different form. Next are potential competitors — those who could move into your arena but haven’t yet.

One of the most important categories people often don’t think of are the oblique competitors. These are competitors who compete for something you need, such as disposable time (which Netflix has said it is contesting!).

A watchword is not to confine your competitor analysis to those players operating within your industry, however you define that. Instead, think of the concept of a competitive arena, representing a set of customers’ jobs to be done, potential solutions and how the ‘job’ might get done better.

First prototype and technical feasibility

Just describing a potential solution isn’t often enough for customers to “get” what you are providing. This is where prototypes, experiments and mock-ups have their moment in the sun. Eric Ries has famously called these things “minimal viable products.” The watchwords here are do a lot (one experiment or prototype isn’t going to teach you much). Be specific about what you want to learn. And employ design thinking to the extent that you can — people like my friend Ryan Jacoby of Machine Io swim in those waters, as do design firms.

Product Data and Digital Strategy Definition

One of the big differences between innovation today and innovation in the past is that today, digital needs to be baked in from the beginning. You have to think through the data implications of your business, potentially sowing the seeds for a rich ecosystem of interactions. A really nice resource on this is Erich Joachimsthaler’s concept of an “interaction field” in which products and services serve as elements in a rich field of value-creating interactions. You can catch a video of him explaining the concept here. An excellent discussion of the evolution of digital in business models was put together by my colleague Ryan McManus and can be found here.

Revised prototypes

The point of a prototype is that it isn’t perfect! Don’t be afraid to change them, update them, throw them away, and pivot! The critical thing is to capture what you have learned so that others can follow along.

Customer segmentation testing

This is a mistake I see all the time, and it’s called demographic segmentation. So we sort out customers by the easy things — age, region, income levels, and so on. The problem is that customer behavior doesn’t neatly map onto these simple, observable characteristics. What you are after instead is behavioral segmentation — what jobs do customers want to get done, how do they feel about those jobs and how do you fit in the bigger picture of the complete customer journey? At this checkpoint, you’re looking to dig more deeply into customer attitudes and preferences — and look for the real ones, not the ones they tell you about!

For example, for many years men who shave were categorized by what kinds of products they used. The insight that allowed Gillette to dominate many of its markets for male shaving gear was that men fell into three distinct behavioral groups with respect to shaving. One group was ‘ritualistic’ with shaving being an important everyday ritual. They wouldn’t feel right if they didn’t shave. Gillette’s high end products were a natural fit. A second group was “begruding” — only shave if I have to, or my wife/spouse/boss expects it. These guys who stayed with Gillette as long as it really offered a more convenient way to get the thing over with were naturals to defect to direct-to-consumer brands such as Dollar Shave Club. A third group, “aesthetic” shavers really want the full on highly cosmetic look that a great shave can product. Those folks were prized candidates for other new entrants such as the Art of Shaving.

No wonder Gillette is feeling the squeeze as other players target the behaviors they used to be able to meet!

Marketing Test

Here, what you’re trying to do is create the descriptive materials that will surround your eventual offering. How will you reach prospective customers? How will you create buzz? What vehicles will you use to connect with them? People often skip over this step, thinking that their initial impulses will be the right answer. Don’t believe that — instead, use techniques like A/B testing to help the market define how you should be conducting your outreach.

This is also a great time to engage in what some have called a “smoke test” which is creating marketing materials for a product or service that is not quite ready to ship. It can be helpful for getting feedback and for helping you to think through what the branding and other requirements for your venture are likely to be. There are many other ways to test market interest quickly and cheaply — this fun article goes through a bunch.

Talent Requirement Assessment

Before you can build a great business, you need to make sure you can attract great people. Unfortunately, attracting people to work on a new business is often a rather haphazard process. It often begins with volunteers. Unfortunately while they bring enthusiasm and excitement, they may not have the skills you need to get the business going. Worst-case, they are fleeing a situation where they are misfits and are escaping accountability to head into the world of new ventures. Next, a heuristic is, “well, who is available?” Guess what — there is often a reason they are available! It then turns to “who do I know?” While that is not necessarily terrible, it limits the pool of potential talent and in all likelihood the diversity of thought that might be helpful to your business. Instead, consider what kind of talent your innovation projects need, at what stage, and how you might go about bringing them into your business.

Another issue with talent in innovation is that innovation jobs are often great jobs but terrible careers. In this terrific article, my colleagues Gina O’Connor, Andrew Corbett and Ron Pierantozzi lay out a way of thinking about innovation career paths. It recognizes that innovations go through three stages — ideation, incubation and acceleration.

Distribution Channel Assessment

OK, so you have the greatest widget in the world. Congratulations! Now, how are you going to get it into the market? Many great ideas have floundered because nobody really thought through where your key customers are, how you will reach them and logistically, how the experience of buying your product or using your service will be. Failing to think through the whole distribution chain has doomed many ventures, for instance the original much-hyped food-delivery company Webvan. Despite vast amounts of funding and maybe even more hype, the company’s leaders could never figure out how to cost-effectively get groceries to consumers within a competitive delivery window for a competitive price.

Instead, think through where your customers are, what keywords they might naturally search for, how they are going to discover your offerings and what will lead them to pick you rather than alternatives. This terrific article offers some ideas on what often goes wrong and how to get the distribution question right.

Trials with Beta Users

By the time you get to this stage, with luck you have confidence that you’ve discovered a real need for which there are few alternatives in the market, you have a working prototype, you’ve at least hypothesized a working business model, and you have enough interest from customers that some of them have agreed to sign up as so called “beta users.” If your offering consists to some extent of something digital (and what doesn’t these days?), you’ll want to find out about the bugs, flawed processes and other issues and remedy them before you launch ‘for real’. To do this, though, you’ll need to recruit beta users, who are ideally people who would actually buy the product or service or engage with your platform because they have a problem you company can address. This article offers some good resources for people looking to find beta testers for apps.

Before you willy nilly sign users up, though, make sure you know what you want to learn from them and make it very easy to give you feedback. Otherwise, they may just disappear and you’ll never know why! In addition, make sure that your team has the resources to properly engage with the beta users — if everybody is “too busy to be bothered” then you are going to miss critical opportunities for learning.

Focus Group Discussions with Beta Users

Great — you now have real, live human beings using your offering! Congratulations. Now is the time to work with them to figure out what is working, what isn’t working, what else they might find that is of value and use those insights to guide your next steps.

At this juncture, it is critically important to fight the very human tendency to embrace information you already agree with and reject information that calls some of your assumptions into question. As Safi Bahcall points out in his fabulous book Loonshots, often the original inspiration for a transformative offering has very little to do with how it eventually gains market acceptance. Unforeseen market benefits are often discovered by customers after the introduction of the product to early users. And ironically, marketers are sometimes annoyed that customers want to use the product in ways they never thought of! The inventor of Novocain, for instance, didn’t want the pain-killer to be used by dentists.

Business Model Definition

Somewhere along the line, you are going to have to figure out what your business model is. That’s the economic logic that will, eventually, you hope, turn a profit. Here, as before, I recommend a discovery driven approach, in which you articulate assumptions about the relevant aspects of your business model and figure out ways to test them. I also try to keep it simple — you can define a business model in its essential elements by specifying a unit of business (what you sell) and the web of activities that surround it, represented by key metrics (how you sell and deliver it).

Further, it’s important to remember that not all business models are equally attractive. Low switching costs, in which customers can easily change from one provider to another, are particularly problematic. So are models in which there are no habits formed — every interaction starts anew. For an article and a diagnostic that describes what makes a business model attractive, see this piece published in the European Business and Financial Review.

Pilot Marketing Campaign

At this checkpoint, we’re now ready to commit serious resources to finding out how we want to launch our first ‘for real’ marketing campaign. This may involved probing into test markets, doing multiple tests with key segments, running lookalike campaigns (in which you try to find more of the same kind of people who are initially attracted to your offer) and other activities.

Unlike beta testing, by the time you get to an initial pilot marketing campaign, you are down to a few contenders for how you want to go to market. Pilot campaigns are also where you will be starting to think about how the various functions that will be involved in eventual launch will work together. For instance, how will marketing integrate with sales? A non-trivial question, particularly if you are looking to use the existing salesforce or existing customer relationships to try to sell something new. Figuring out points of friction and disagreement here can save a boatload of heartache later on.

Product: Final Design, Sourcing, Planning

OK, time to pay off technical debt! Now you have to go from an initial prototype to something that works, for real, in the actual use case for which it is intended. By now, you’ll need to have full specifications for all the aspects of your offering defined. You’ll need to have buttoned down procedures for things like quality control. And you really will need to get those bugs that you’ve been letting slide under control. If you don’t get to them now, it will make fixing them later an ever-growing problem.

Engineering/Operations Recruitment and Training

If you thought technical debt was bad, organizational debt is worse. This is the checkpoint at which you are going to be implementing your talent strategy. Your little venture at this stage will have been starting to go through a phase change, with different parts of the organization having to mature. Right around now, your blank-piece-of-paper people start to roll their eyes in meetings in which the main topics are operational and detail oriented.

This is the challenge of what Gina O’Connor calls “acceleration.” The metaphor is apt — your little business is just on the “on” ramp to joining the high-speed highway that is your mothership. It needs to be able to get up to speed and accelerate, or it is going to get run over.

Product Build

If you haven’t got one by now, this is the point at which you need to bring in a heavyweight product manager role. Martin Erikson defines a product manager as someone who sits at the intersection between the user, the technology and the business (and offers a Venn diagram to boot!).

As a checklist, Ben Horowitz’s definition of good product managers vs. bad product managers, while a little dated, makes for an interesting read.

Business Development Recruitment and Training

A great model for a making innovation an ongoing practice in your organization is offered by Curtis Carlson, former CEO of SRI International and a champion for innovating systematically. He suggests thorough training of all your people in a four-part approach to innovation he calls NABC.

The “N” is for deep understanding of customer needs. As described above, this needs to be absolutely clear to everyone before you really have a program you can move forward with.

The “A” stands for approach the business takes to addressing the “N,” which includes many of the checkpoints addressed above.

“B” is benefits relative to cost, where the cost to the customer of an innovation can be both financial and in terms of other factors such as retention.

“C” stands for competition both from traditional competition and from alternatives to doing business with you, as described above.

Customer Success and Service Recruitment and Training

There are several distinct activities that you will need to incorporate in the customer-facing part of your business. The most obvious is customer support — responding to a customer when they tell you they have a problem. The second is customer service — reaching out to customers with a new offer or an improved way of working. A third is customer success — thinking all the way through your customers’ business to help them be successful in whatever goal they choose.

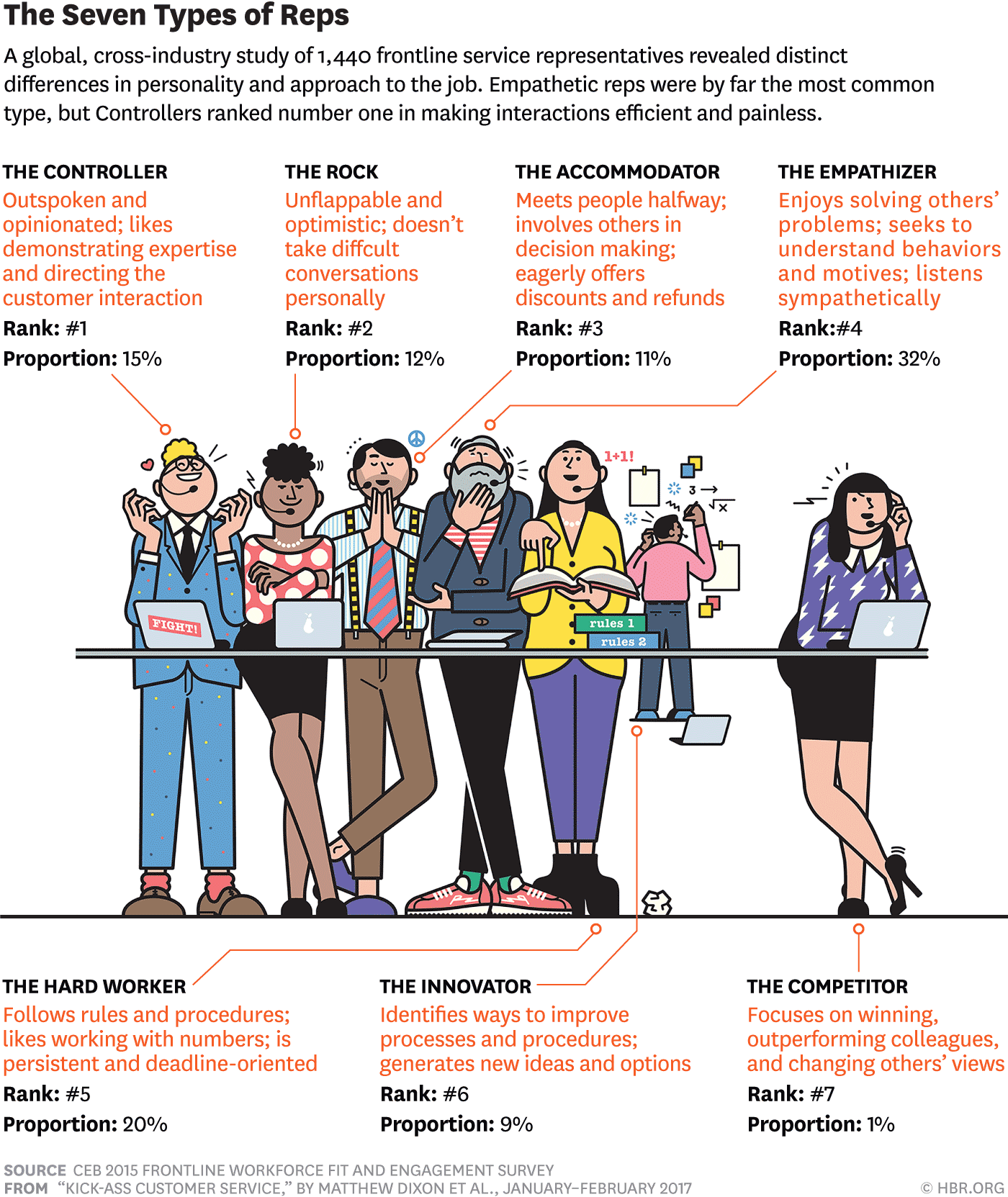

One of the dilemmas of building a customer service organization today is that automation has allowed most customers to self-serve the routine and simple problems. This leaves the more complex and convoluted ones for your people to resolve. As a recent Harvard Business Review article observed of a leader at a major retail operation, “Our people are woefully ill-equipped to handle today’s customers and their issues. We’re not running a contact center here. It’s more like a factory of sadness.” The cost of a live service interaction has skyrocketed over the past ten years, as has dissatisfaction and high churn among service reps. In their research, Matthew Dixon, Lara Ponomareff, Scott Turner, and Rick DeLisi found that a particular type of representative, one they term the “controller” vastly out-performed other types. As they say, ‘customers want a solution, not sympathy.’ Their typology of service reps is below.

Providing outstanding customer service is unfortunately often regarded as a cost, rather than an opportunity to build relationships and grow revenue. A potential solution lies in Zeynep Ton’s proposals that we need to be thinking more in terms of good jobs and top-line growth than in purely minimizing service costs.

Product Launch

A lovely summary of how to plan for a perfect product launch can be found here.

Scale Deployment

It’s showtime! By the time you get to this stage of a venture, you have survived the initial challenges, identified the customers you want to serve, solved often-daunting obstacles and are now ready for the big time. As entrepreneur and investor Ben Horowitz outlines, in an excellent article on the scaling challenge, that what you need to think about is to metaphorically “give ground grudgingly.” What this means is to introduce the necessary practices and processes in your organization to keep it running smoothly, but to do so in a way that doesn’t wreck the innovative capability that make it exciting to begin with.

Another great resource for the scaling checkpoint (which could have a whole encyclopedia of additional sub-checkpoints) is Huggy Rao and Bob Sutton’s terrific book Scaling Up Excellence. Since I’m focusing here on the challenge of building something new, I’ll defer to them for guidance on that.

Building tools to automate this process — Introducing SparcHub

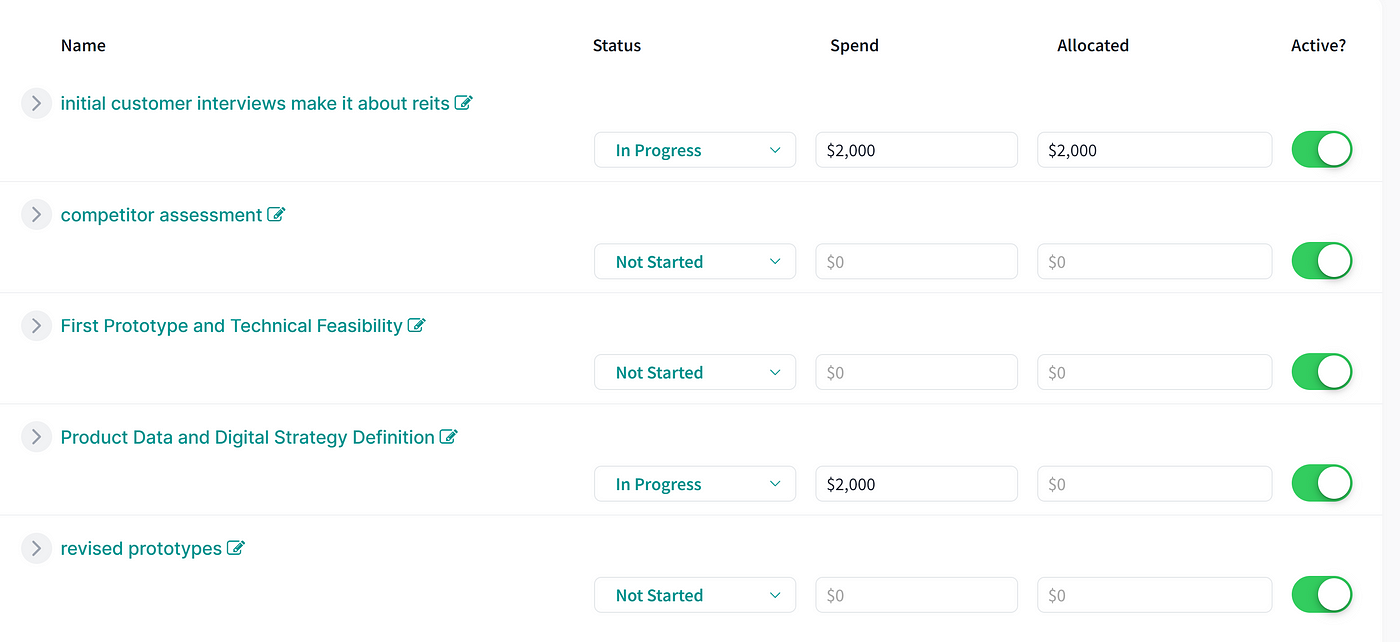

After many years of trying, I’m now able to offer a version of a software tool that allows people working on growth programs to work through these checkpoints, capture information about them, put a price tag on them and allow other people to contribute their insights as well. The checkpoints work together with an assumptions checklist, which lets you see what critical business assumptions are going to be tested, when, and for what price.

Here’s what the record looks like for one checkpoint — I chose initial customer interviews.

What the system captures at the checkpoint is which assumptions are being tested, what it cost, whether it is active or not — and, the most important thing — the story about how that checkpoint was navigated and what was learned. All the different checkpoints have this information, and we’ve designed the system to capture the journey as it unfolds.

You can see what the screen looks like in the checkpoint sequence above.

If you are curious, and would like to learn more about the software and how we use it, do get in touch! [email protected] will find us.